Calculating your net worth worksheet answers chapter 1 lesson 4 – Embark on a journey of financial self-discovery with “Calculating Your Net Worth: A Comprehensive Guide.” In this meticulously crafted guide, we delve into the intricacies of assessing your financial standing, empowering you to make informed decisions that shape your financial future.

Understanding your net worth is paramount to gaining a clear picture of your financial health. This guide provides a step-by-step approach, guiding you through the process of calculating your net worth and analyzing its implications.

Calculating Your Net Worth Worksheet Answers

Calculating your net worth is an essential step in understanding your financial position and making informed financial decisions. This worksheet will guide you through the process of calculating your net worth and provide you with valuable insights into your financial health.

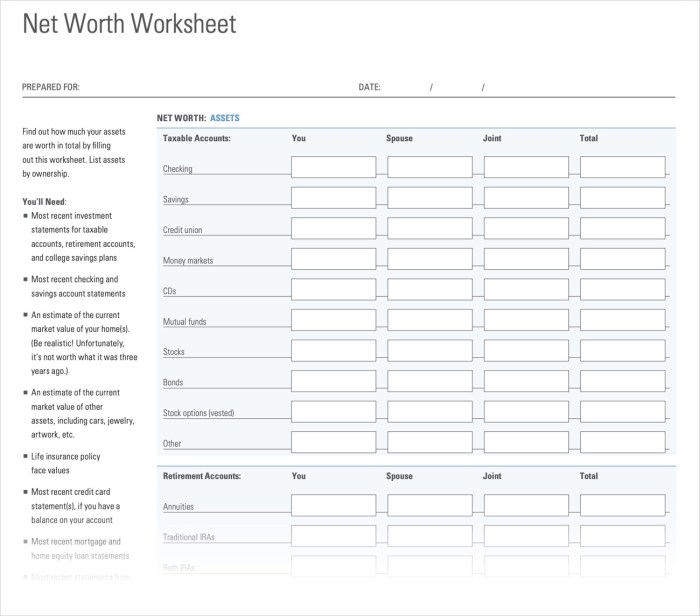

Worksheet Instructions

- Gather all necessary financial documents, such as bank statements, investment statements, and loan documents.

- Complete each section of the worksheet by following the instructions provided.

- Use accurate and up-to-date information to ensure the accuracy of your net worth calculation.

Assets, Calculating your net worth worksheet answers chapter 1 lesson 4

- Identify all of your assets, including cash, investments, real estate, and personal property.

- Value your assets accurately using current market values or appraisals.

- Examples of common assets include cash, savings accounts, stocks, bonds, real estate, and vehicles.

Liabilities

- Identify all of your liabilities, including debts, loans, and mortgages.

- Calculate the current balance of each liability.

- Examples of common liabilities include credit card debt, student loans, and car loans.

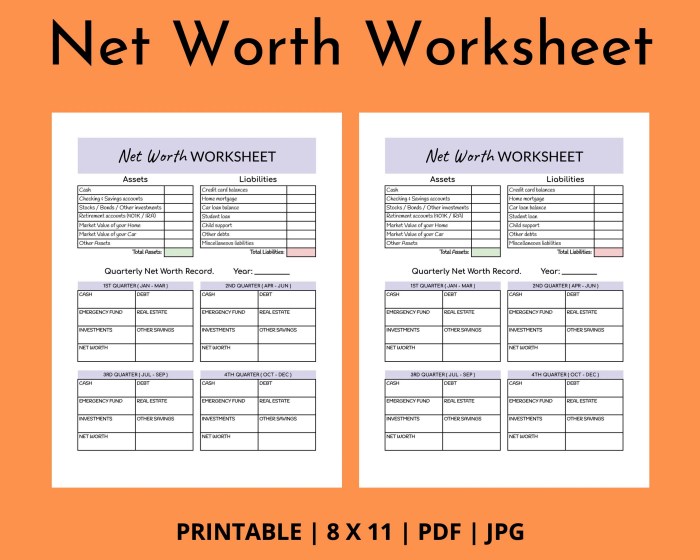

Net Worth Calculation

To calculate your net worth, subtract your total liabilities from your total assets.

Net Worth = Assets – Liabilities

Worksheet Analysis

- Regularly calculate your net worth to track your financial progress.

- Identify areas where you can improve your financial situation, such as reducing debt or increasing savings.

- Use your net worth calculation to make informed financial decisions, such as setting financial goals or adjusting your investment strategy.

Example Worksheet

| Assets | Value |

|---|---|

| Cash | $1,000 |

| Savings Account | $5,000 |

| Investments | $10,000 |

| Real Estate | $200,000 |

| Personal Property | $5,000 |

| Total Assets | $221,000 |

| Liabilities | Value |

| Credit Card Debt | $5,000 |

| Student Loans | $20,000 |

| Car Loan | $10,000 |

| Total Liabilities | $35,000 |

| Net Worth | $186,000 |

This example worksheet shows a net worth of $186,000. This indicates that the individual has more assets than liabilities, which is a positive financial position.

Q&A: Calculating Your Net Worth Worksheet Answers Chapter 1 Lesson 4

What is the purpose of calculating my net worth?

Calculating your net worth provides a snapshot of your financial health, helping you understand your financial position and make informed decisions.

How often should I calculate my net worth?

It is recommended to calculate your net worth at least annually, or more frequently if your financial situation changes significantly.

What are some common mistakes to avoid when calculating my net worth?

Common mistakes include overlooking liabilities, overvaluing assets, and failing to consider future financial obligations.